The quest for an economy driven by clean, abundant and affordable renewable energy remains an unfulfilled dream—though not for lack of lobbying, a supportive media and lots of government money. A highly touted source of such renewable energy is wind power—after all, wind is free, right? Propelled by a number of beneficial policies, wind power has made some gains but still faces several probably insurmountable challenges to becoming a dependable part of America’s energy portfolio.

According to the U.S. government’s Energy Information Administration (EIA), wind provided 167 million megawatt hours (MWh) of U.S. electricity in 2013, up 19 percent from 2012.1 Even so wind accounts for only 4.1 percent of total U.S. electricity generation, and it is virtually certain it wouldn’t have achieved even that level without huge taxpayer subsidies.

And with that growth wind power is still a regional phenomenon. While wind turbines provide 27.4 percent of Iowa’s electricity, only 12 states produce 80 percent of U.S. wind energy, and large sections of the U.S., such as the Southeast, produce little or no energy from wind.

Some of wind’s other challenges include:

It’s Expensive

The Energy and Policy Institute writes, “Wind energy is a rapidly growing and profitable business worldwide, usually at the expense of fossil fuel generation revenue and, more importantly, profits.”2 Actually, it would be more accurate to say that wind energy’s growth is at the expense of taxpayers and ratepayers.

Since 1992 the U.S. has provided a wind Production Tax Credit (PTC), a 2.3-cent per kilowatt-hour subsidy that costs taxpayers nearly $2 billion in 2013. That tax credit no longer exists for wind farms constructed after 2013, but existing ones can claim it for 10 more years.

And yet the federal government is still funding wind farm projects. The Department of Energy recently announced a $150 million loan guarantee for the construction of the Cape Wind offshore (Massachusetts) wind project, and that’s after scrambling to sign a contract with turbine-maker Siemens in the last days of 2013 in order to qualify for a $780 million PTC—after claiming it had begun construction, as the law requires, before signing the Siemens contract.

Wind energy defenders assert that fossil fuels get much larger tax breaks, and have been doing so for decades, but that claim is misleading.

(1) Most of the fossil fuel tax breaks are widely available to companies in other industries, and are not exclusive to the oil and gas industry. For example, critics often cite Section 199, which is part of the domestic production activities deduction included in the bipartisan 2004 American Job Creation Act. It provides a 9 percent tax deduction for businesses that manufacture, sell, lease or license a product, as well as related engineering and software activities. The deduction was intended to give domestic manufacturing a slight competitive advantage against foreign competition. Oil and gas companies use that tax break, but Congress only allows them a 6 percent deduction, rather than the 9 percent that other industries receive.

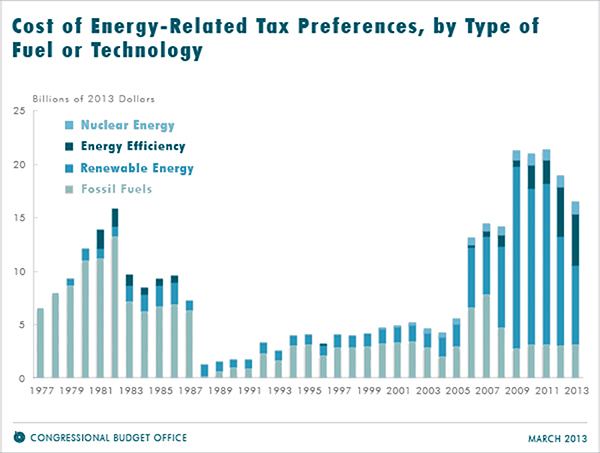

(2) Since wind energy, and renewables in general, generate only a small percentage of U.S. electricity, wind actually gets a disproportionately large tax subsidy. For example, the Congressional Budget Office (CBO) reports that renewable energy received 45 percent of FY 2013 energy-related tax preferences, and projects promoting energy efficiency received 29 percent. Fossil fuels received only 20 percent.

However, fossil fuels produced 87 percent of U.S. electricity generation, hydro produced 7 percent and all other renewables combined about 6 percent. [See graph.]

Would the wind energy industry even exist without those breaks? The Union of Concerned Scientists admits: “Congress has extended the [PTC] provision five times and has allowed it to expire on five occasions. This ‘on-again/off-again’ status has resulted in a boom-bust cycle of development. In the years following [PTC] expiration, installations dropped between 76 and 93 percent, with corresponding job losses.”3 And investor Warren Buffett recently said about the PTC, “That’s the only reason to build them. They don’t make [financial] sense without the tax credit.”

Taxpayers aren’t the only ones subsidizing wind—so do ratepayers. Wind energy lobbyists have managed to convince 29 states to require utilities to include a specific percentage or amount of renewable energy—creating, in essence, a government-mandated market for wind.

EIA data show that nine of the 11 states where wind accounts for more than 7 percent of electricity generation—CO, ID, IA, KS, MN, ND, OR, SD, WY—saw significantly higher energy price increases, between 14 percent (CO) and 33 percent (ID, WY).

It’s Harmful

Environmentalists contend that fossil fuels are harmful to the environment; well, so are huge wind turbines. And one of their primary problems is they kill birds, especially raptors like hawks and eagles. The U.S. Forest and Wildlife Service estimates that half a million birds are killed a year due to wind turbines.

Because some of those birds are federally protected, the Obama administration recently finalized a rule that grants wind farms a 30-year permit. As long as they are trying to avoid killing protected birds like the bald eagle, federal officials won’t prosecute them.

There is also a human toll. Wind turbines can make a noise, sometimes within the audible spectrum, sometimes not. But they are alleged to negatively affect the health and quality of life of people living in close proximity, creating what is being called “wind turbine syndrome” (WTS).

It’s Unreliable

Wind power is unreliable, or “non-dispatchable,” which means it may not be available during peak usage. Thus, generating plants must have a ready back up of “dispatchable” fuel sources—such as coal or natural gas—that can be called on anytime to meet rising demand. That redundancy adds to the cost of wind energy.

As economist Charles R. Frank, Jr., writes in his study, “The Net Benefits of Low and No-Carbon Electricity Technologies”: “Wind plants can operate at a capacity factor of 30 percent or more and cost about twice as much per MW to build as a gas combined cycle plant. Taking account of the lack of wind reliability, it takes an investment of approximately $10 million in wind plants to produce the same amount of electricity with the same reliability as a $1 million investment in combined cycle plants.”4

It’s Losing Favor

When pollsters ask the public whether expanding renewable energy is a good idea, they respond in the affirmative. Everyone wants a clean environment.

However, when asked to rank priorities facing the country, somewhere between 3 percent and 8 percent think the “environment”—the broader and more generic term that often includes support for renewable energy—is a top issue. In addition, public concern over related issues such as climate change has been declining.

Conclusion

Though making dramatic advances over the past two decades, wind energy is still a marginal player in electricity generation. But even that marginal success has come at a huge taxpayer and ratepayer cost. The public’s willingness to continue to pour billions of dollars into wind energy, through higher taxes or rates, appears to be coming to a close.

Endnotes

-

U.S. Energy Information Administration, Today in Energy

-

Energy and Policy Institute, “Wind Energy: A Mature Business Challenging Fossil Generation Profits,” April 4, 2014.

-

Union of Concerned Scientists, “Production Tax Credit for Renewable Energy,” Last revised Jan. 31, 2014.

-

Charles R. Frank, Jr., “The Net Benefits of Low and No-Carbon Electricity Technologies,” The Brookings Institution, Working Paper 73, May 2014.