For more than 20 years Congress made available what’s referred to as the "Production Tax Credit" (PTC) to encourage the development of wind energy. That tax credit, 2.3-cents per KWH credit for 10 years, expired in 2013. But there are bipartisan forces that want to revive it—because they benefit financially from it.

However, with the recent dramatic increase in U.S. fossil fuel production, energy for electric power generation is both abundant and affordable—and cleaner than ever. There is no longer any need for the PTC subsidies.

The PTC Costs Taxpayers Billions

The Production Tax Credit’s 2.3-cent per KWH subsidy cost taxpayers nearly $2 billion in 2013.1 This is not a subsidy to consumers; it goes to the companies and investors building and operating wind turbines.

But that’s not the only way the federal government subsidizes wind farms. For example, after the government approved in the waning hours of 2013 a $780 million PTC for the Cape Wind project, based offshore in Massachusetts’ Nantucket Sound, the Department of Energy announced in April it was providing a $150 million loan guarantee. That’s a total of $930 million in taxpayer support for only one wind farm.

Would the wind energy industry even exist without the PTC? The Union of Concerned Scientists admits: "Congress has extended the [PTC] provision five times and has allowed it to expire on five occasions. This ‘on-again/off-again’ status has resulted in a boom-bust cycle of development. In the years following [PTC] expiration, installations dropped between 76 and 93 percent, with corresponding job losses."2 And investor Warren Buffett recently said about the PTC, "That’s the only reason to build them. They don’t make [financial] sense without the tax credit."

The PTC Raises Consumers’ Energy Costs

Wind energy also receives indirect subsidies through higher utility bills. For example, tax breaks and loan guarantees for Cape Wind will only cover about 58 percent of its costs. So the project’s owners entered an agreement with Massachusetts’ two largest utilities to buy 77.5 percent of Cape Wind’s output at an elevated starting price of 18.7 cents per KWH, which will be allowed to increase by 3.5 cents per KWH annually for 15 years.

That cost is 230 percent higher than the typical 8.1 cents per KWH of electricity and even more than twice the cost of land-based wind power in neighboring states. News reports claim that many Bay Staters would be paying nearly 50 percent more for electricity beginning November 1, 2014.

Brookings Institution Senior Fellow Charles Frank recently published a comparison of low-carbon energy options to fossil fuels. His conclusion:3

Adding up the net energy cost and the net capacity cost of the five low-carbon alternatives [wind, solar, hydro, nuclear, combined cycle gas], far and away the most expensive is solar. It costs almost 19 cents more per KWH than power from the coal or gas plants that it displaces. Wind power is the second most expensive. It costs nearly 6 cents more per KWH. Gas combined cycle is the least expensive.

To place these additional costs in context, the average cost of electricity to U.S. consumers in 2012 was 9.84 cents per KWH, including the cost of transmission and distribution of electricity. This means a new wind plant could at least cost 50 percent more per KWH to produce electricity, and a new solar plant at least 200 percent more per KWH, than using coal and gas technologies.

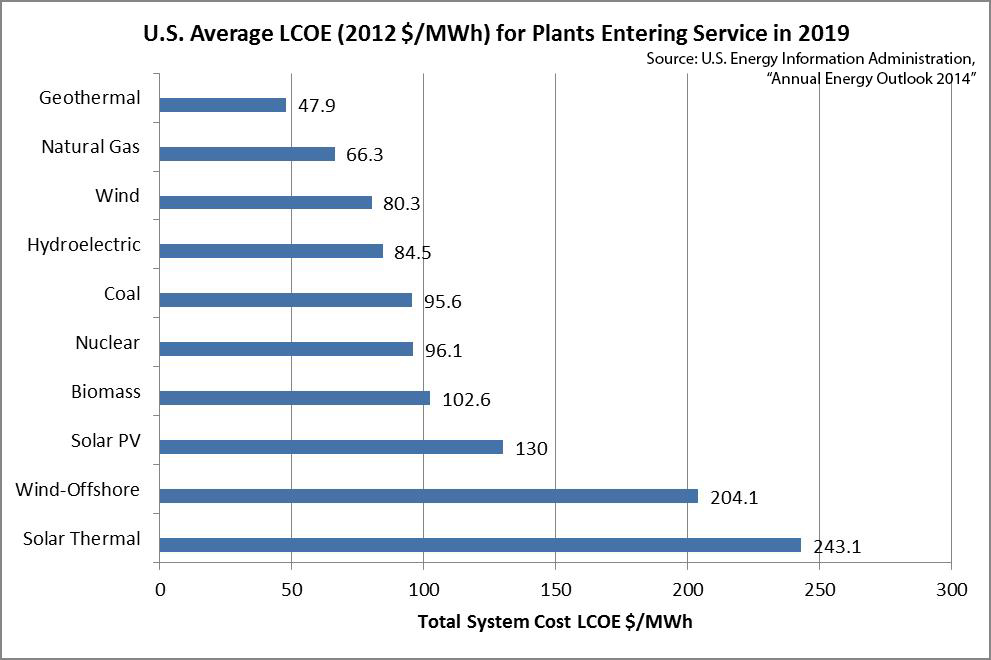

As the figure shows, cost comparisons by the U.S. Energy Information Administration support Frank’s claims.

In his explanation for why wind and solar power generation are so high, Frank reiterates what many already have:

- Neither wind nor solar can operate anywhere near full capacity because of their variability. "For example, a typical solar plant in the United States operates at only about 15 percent of full capacity and a wind plant only about 25 percent of full capacity, while a coal plant can operate 90 percent of full capacity on a year-round basis. Thus it takes six solar plants and almost four wind plants to produce the same amount of electricity as a single coal-fired plant."

- Just building the wind or solar plant is very expensive. "In dollar terms, it takes a $29 million investment in solar capacity, and $10 million in wind capacity, to produce the same amount of electricity with the same reliability as a $1 million investment in gas combined cycle capacity."

States Are Complicit

If wind power generation is so much more expensive than fossil fuels, why would utilities include them? Because state legislatures mandate it.

Renewable energy mandates are known as the Renewable Portfolio Standards (RPS), which the National Conference of State Legislatures (NCSL) describes as "standards [that] require utilities to sell a specified percentage or amount of renewable electricity."4 Utilities enter long-term agreements, known as Power Purchase Agreements (PPAs), guaranteeing they will buy the higher-priced wind energy—and pass those costs on to consumers.

Iowa was the first to mandate an RPS, in 1991. Since then, 29 states and the District of Columbia have adopted an RPS and eight states have set a voluntary renewable energy standard goal.5 While the mandate may start small, it usually increases over time as presumably more renewable power options are up and running. Most states are mandating between 15 percent and 20 percent by 2020 or 2025. Thirteen states have no RPS at all.

Higher Wind Prices Hurt the Poor

Renewable energy is not a priority for the poor who are more concerned about whether they can afford their electric bill than whether that electricity came from a wind turbine.

And yet Renewable Portfolio Standards impose higher electricity prices—what we might call the "wind premium"—hitting low-income Americans the hardest. For example, the Cape Wind project is forcing ratepayers to pay 50 percent more for their electricity. That would push up a $100 electricity bill to $150, which could be several days worth of food for a low-income family.

And the San Francisco-based Energy+Environmental Economics consulting firm projects that California’s electricity is likely to rise 47 percent (adjusted for inflation) over the next 16 years, in part because of wind energy mandates.6

Wind Energy Harms the Environment

One major problem with wind turbines is they kill birds, especially raptors like hawks and eagles. The U.S. Forest and Wildlife Service estimates that half a million birds are killed a year due to wind turbines.7 Because some of those birds are federally protected, the Obama administration recently finalized a rule that grants wind farms a 30-year exemption from laws.8

Conclusion

The U.S. has subsidized wind turbines for two decades, and yet supporters want even more. Renewing the PTC for one year will cost the government an estimated $6.1 billion, and $18.5 billion for five years.

It is time to cut those subsidies by not renewing the Production Tax Credit. Not only do we not have the money, but the country has abundant, less-expensive and more-reliable energy sources at its disposal.

Endnotes

1. Oversight of the Wind Energy Production Tax Credit, Oct. 2, 2013

2. Union of Concerned Scientists, “Production Tax Credit for Renewable Energy.”

5. Jonathan Walters, “Renewable Energy Requirements Get a Second Wind,” Governing, April 2014.

7. U.S. Forest and Wildlife Service, “Wildlife Concerns Associated with Wind Energy Development.”