David R. Henderson is an Emeritus Professor of Economics at the Naval Postgraduate School in Monterey, California, a Research Fellow with the Hoover Institution at Stanford University, and a Senior Fellow with Canada’s Fraser Institute. He was previously a senior economist for health policy and for energy policy with President Reagan's Council of Economic Advisers.

David is the editor of The Concise Encyclopedia of Economics, the only reader-friendly encyclopedia of economics, and has written 2 other books, The Joy of Freedom: An Economist’s Odyssey and Making Great Decisions in Business and Life (co-authored with Charles L. Hooper.) As well as publishing in academic journals, he has written over 300 articles for such popular publications as the Wall Street Journal, New York Times, Barron's, Fortune, Los Angeles Times, Washington Post, USA Today, Chicago Tribune, National Review, Defining Ideas, and Reason.

He has testified before the House Ways and Means Committee, the Senate Armed Services Committee, and the Senate Committee on Labor and Human Resources. He has also appeared on C-SPAN, CNN, the Jim Lehrer Newshour, the John Stossel show, the O’Reilly Factor, the Ingraham Angle, MSNBC, RT, NPR, CBC, and the BBC.

Born in Canada, he moved to the United States in 1972 to earn his Ph.D. in economics at UCLA. He became a U.S. citizen in April 1986.

The Coming Battle to Repeal an Unconstitutional Income Tax

Washington State's voters, rather than its legislature and Supreme Court, may be able to force the state to follow its Constitution.

Higher Immigration Will Reduce the Federal Deficit

CBO confirms a growing supply of labor, in part due to growth in immigration, will boost economic growth.

Tabling TABOR

Colorado voters passed a TABOR Amendment in 1992 to ensure taxpayers benefited from state budget surpluses. That didn't stop the legislature from trying to undermine voters' intentions.

How Much Does $100 Billion in Federal Spending Cost You?

Americans would push back more on government spending if they knew how much each proposal would actually cost them.

Massachusetts Cuts--and Complicates--Taxes

You know progressives are concerned about tax flight when even Massachusetts decides to cut state tax rates.

Iowa Leads the Way on Tax Cuts

Iowa was once a leader in high individual and corporate income tax rates; now it's a leader in lowering those rates—and cutting spending.

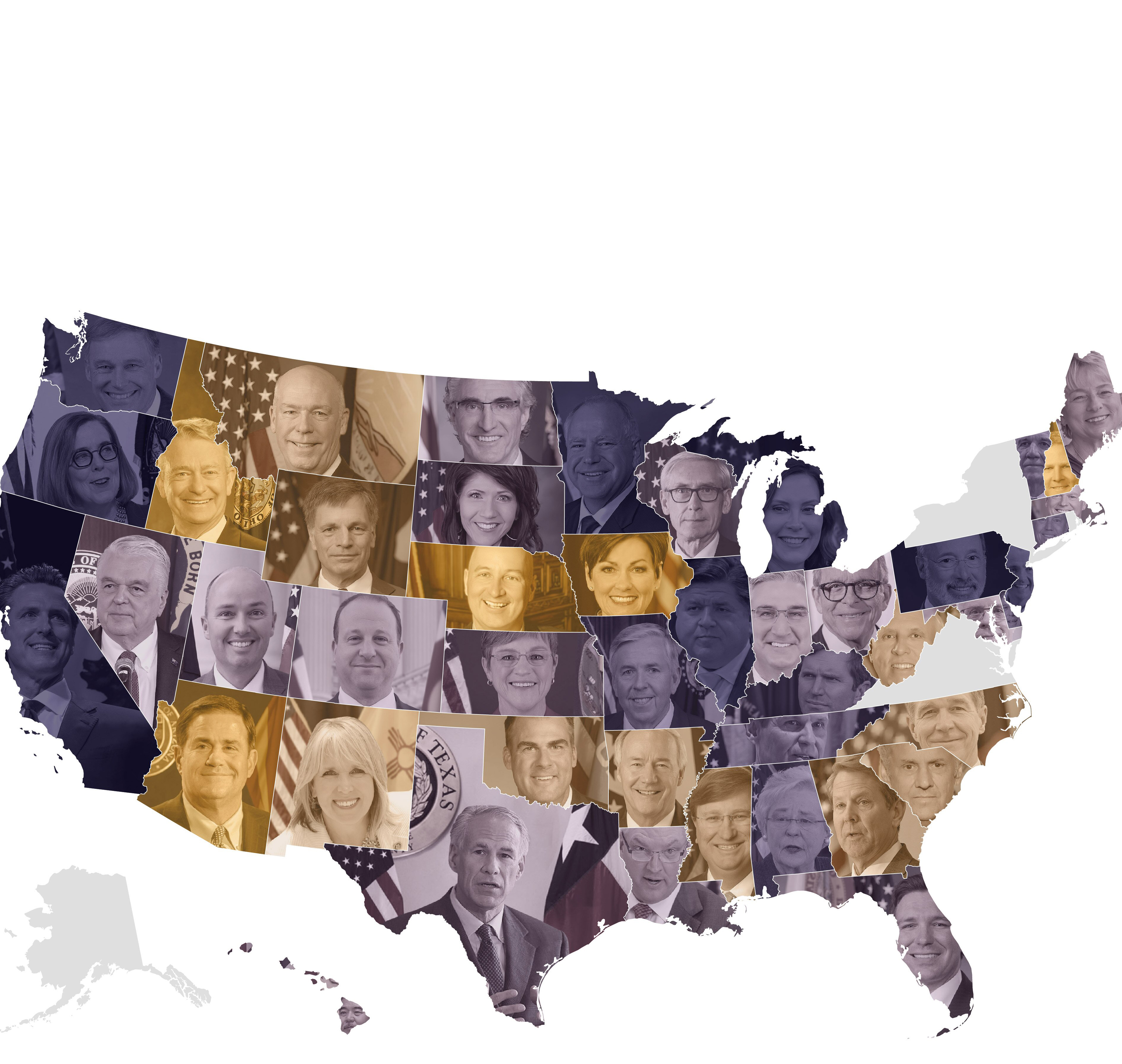

How to Judge Governors Running for President

Governors create a fiscal record that can help voters decide who might make the most fiscally responsible president.

Reducing 'Tax Expenditures' Can Hurt Economic Growth

Rethinking and bad thinking about the notion of "tax expenditures."

The Bizarre Economics of 'Tax Expenditures'

The term "tax expenditure" may not mean what you think it means.

Don't Trade SALT for Broccoli

Physicians may think too much salt is bad for your health, but many economists believe some SALT is good for the economy.