Taxes directly affect Americans by compelling them to surrender part of their income to the government, and indirectly since the taxing power can positively or negatively affect economic growth.

In the U.S., our tax regimes are in serious need for reform, both at the state and federal level. Our tax code fails to sufficiently incentivize investment, the primary driver of economic growth. And it hobbles U.S. companies as they compete internationally.

IPI believes that the purpose of taxes is to raise the revenue necessary to fund the legitimate functions of government while imposing the least possible impact upon the functioning of the economy. We therefore believe that taxes should be simple, transparent, neutral, territorial and competitive.

Because of its tremendous potential to stimulate real long-term economic growth, tax reform should be a top priority of policymakers.

The Courage of their Limited Government Convictions

With the next round of sequester spending restraints scheduled to hit in 2014, we’re about to find out which Republicans have the courage of their supposed limited government convictions.

Taxpayers Foot The Bill For Study Supporting New Internet Sales Taxes

In addition to the new paper, the SBA Office of Advocacy has begun a social media campaign to promote both the paper and Internet sales taxes. IPI even found a list of suggested Twitter tweets that the Office of Advocacy wrote for supporters to use to promote the flawed report.

Reform is Just a Word, in Taxes as in Health Care

Tax reformers need to keep a clear vision of what they’re trying to accomplish with tax reform, because if the purpose of the reform is to stimulate economic growth it must increase the after-tax rate of return to capital, otherwise reform could actually make things worse.

Why JFK was kind of a crappy President

Polls regularly put Kennedy in the top 10 U.S. presidents and a recent Politico poll ranking the best presidents since 1950 has him in first place. Like another more-recent, young, telegenic, liberal presidential candidate, JFK may have brought new hope and promise to the White House, but not much more.

It Is Time To Act Like A European Welfare State

For years various politicians have warned that following the public policy decisions of European countries too closely would take us down a path to becoming a European welfare state. But following the lead of one European country now would likely help the U.S. move towards a healthy, freer, growing economy.

The Last Acceptable Discrimination? (Part 2)

Those who propose policies that are understood to discriminate against the Internet or technology in general take a huge risk and yet the proposals keep on coming.

Continued Innovation Requires Government Cooperation

One clear theme from IPI’s Fifth Annual Communications Policy Summit is that we don’t need government to direct, fund or control innovation—we just need government to listen, learn, and cooperate where necessary.

The GAO and New Tax Math: Computation By Deception

We need tax reform, and we need fact-finding government agencies to bring forward the facts instead of biased or misleading analysis.

The Last Acceptable Discrimination?

When did it become acceptable to propose and enact laws that discriminate against technology and its users?

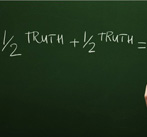

Reporting on Corporate Taxes: Two Half Truths Equal a Misrepresentation

Corporations pay a range of local, state and international taxes regardless of their federal tax liability which is not found in corporate reports. So, what is with these headlines about companies not paying much tax? Only half-truths.