Taxes directly affect Americans by compelling them to surrender part of their income to the government, and indirectly since the taxing power can positively or negatively affect economic growth.

In the U.S., our tax regimes are in serious need for reform, both at the state and federal level. Our tax code fails to sufficiently incentivize investment, the primary driver of economic growth. And it hobbles U.S. companies as they compete internationally.

IPI believes that the purpose of taxes is to raise the revenue necessary to fund the legitimate functions of government while imposing the least possible impact upon the functioning of the economy. We therefore believe that taxes should be simple, transparent, neutral, territorial and competitive.

Because of its tremendous potential to stimulate real long-term economic growth, tax reform should be a top priority of policymakers.

Tax Increases Will Exacerbate Future Economic Downturns

Financial planners advise investors to diversify; but President Obama is demanding even more financial concentration.

Boehner to House GOP: Read My Lips--Break Your Campaign Promises

The Back Room Sales Pitch to Raise Your Taxes on the Internet

Last week state elected officials swarmed Capitol Hill to pressure Congress to support the so-called Marketplace Fairness Act. Congress owes the country an open, recorded debate before risking the United of our United States.

How to Cut Spending

If people believe that government is too big and spends too much money, why can’t we build political support for spending cuts?

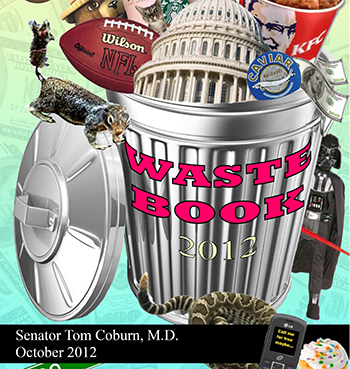

If This Wasteful Federal Spending Doesn't Make You Angry, You're Dead

Before Congress raises taxes it needs to cut wasteful spending; Senator Coburn has shown us were to start.

Stand by that pledge

Stand fast, keep your promise, says a coalition of interest groups, including IPI, that implore lawmakers not to waver on the Taxpayer Protection Pledge, even as Democrats and select Republicans insist that the only alternative to the "fiscal cliff" is instant compromise. Not so, says the coalition.

Coalition Letter Urging Fidelity to Taxpayer Protection Pledge

It's Really About Control

Calls for higher taxes on the wealthy are not really about “fairness,” but rather are about who controls and directs capital in our economy—capitalists themselves or government elites?

Democrats Stop Blaming Bush and Start Blaming Grover Norquist

In their endless quest to blame someone other than their own policies for the country’s economic ills, liberals are focusing less on former President George W. Bush and more on Grover Norquist, founder and president Americans for Tax Reform and creator of the “Taxpayer Protection Pledge.”

Papering Over Failure--with Your Money

Congress and the President have failed—utterly—to run a government that operates within a reasonable level that the American economy can afford to fund. When they talk about raising taxes, they are just trying to paper over their failures—with your money.