Only three months ago President Donald Trump was basking in the glow of a strong and rapidly improving economy.

Businesses across the country announced employee raises and bonuses, companies boasted that they were bringing billions of overseas dollars home and investing it in hiring and new factories.

And consumer and employer confidence was soaring. So was the stock market, which creates a “wealth effect” that encourages people to make new purchases.

Then Trump imposed tariffs on steel and aluminum and raised the possibility of a broader trade war, primarily with China. The Chinese government reciprocated.

But while Trump is imposing or threatening tariffs on what he perceives as aggrieved U.S. industries, the Chinese are being much more strategic in their tariffs. Any industry could be targeted.

Take soybean growers and pork producers, for example. They aren’t guilty of trade infractions, yet China targeted them. Think those farmers will be rushing out to buy new equipment or expand their production?

A city official overseeing the building of a public school told me he was just informed that the steel rebar would cost $100,000 more than predicted, thanks to Trump’s steel tariff. Will infrastructure projects be postponed if the costs can’t be accurately assessed?

Administration officials are trying to reassure the public, businesses and investors that we are not in a trade war—yet. They claim much depends on the outcome of negotiations with China in the near future.

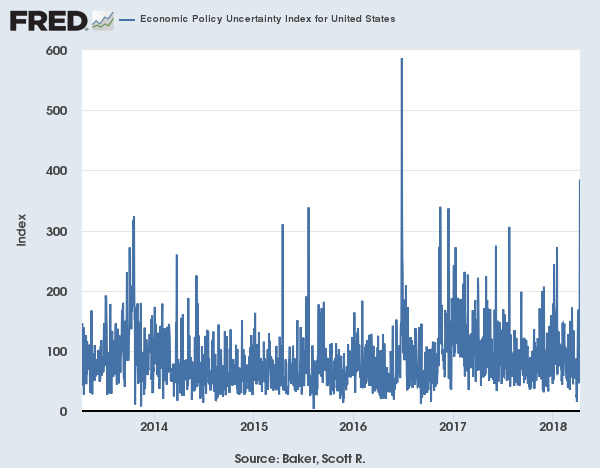

But just the threat of a trade war could create so much uncertainty that it tanks the economy. Just look at the St. Louis Federal Reserve Bank’s uncertainty index, which recently shot up to its second highest level in the past five years.

If you’re a CEO, do you move forward with that planned hiring or investment or expansion you thought justified just three months ago? Or do you hold off knowing that China could, at any moment, retaliate by imposing steep tariffs on your products or services? If you have already ramped up production, do you begin scaling back to reduce inventories, which often means laying off workers?

As a consumer, do you buy that new car or house you were considering, based on those good economic prospects and the stock market’s wealth effect, or do you wait?

The point is that political and economic uncertainty discourages business investment, which is one reason economic growth was so tepid during the Obama years. In three short months Trump has managed to turn one of the most stable business environments in modern history into one of the most uncertain.

Republicans had been hoping that the booming economy of January would carry on through November, helping them overcome the electoral headwinds they currently face.

But if Trump’s trade-war mongering tanks the economy, perhaps even creating a recession, Democrats will claim it's all because of Trump’s tax reform. And Trump may find himself facing a Democratically controlled House or Senate, or both.