Introduction: The Link Between Saving and Investment

Saving matters primarily because the investment it finances determines the growth of income and living standards in a country. In today’s turbulent times, a higher saving rate could not only maintain a strong economy but also a strong military defense. Today’s saving provides the wherewithal for tomorrow’s consumption. Increases in U.S. living standards depend upon the rate of investment in physical capital such as plant and equipment as well as intangible capital such as research and development (R&D) and intellectual capital.1

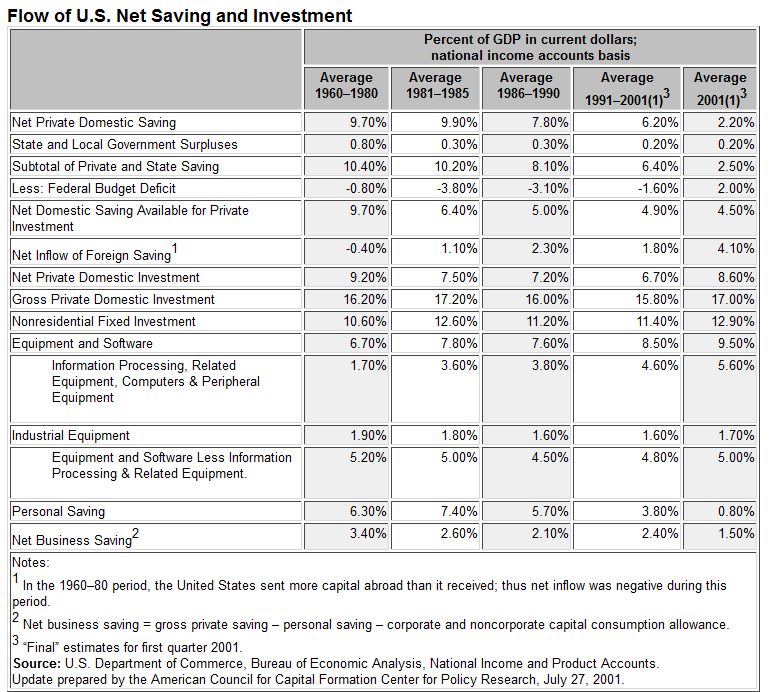

As shown in Table 1, U.S. domestic saving available for private investment has declined from an average of 9.7 percent of GDP over the 1960–1980 period to only 4.9 percent from 1991–2001. Thus, an inflow of foreign saving has provided much of the wherewithal for the surge in investment during the latter half of the 1990s.

Source: U.S. Department of Commerce, Bureau of Economic Analysis, National Income and Product Accounts.

Update prepared by the American Council for Capital Formation Center for Policy Research, July 27, 2001.

U.S. competitiveness in world markets depends heavily upon the growth of efficiency in output, or productivity. Efficiency in output grows out of advances in technology, which in turn require sustained and effective investment in R&D. The United States is a high-wage, capital-intensive economy, and it competes with many low-wage economies around the world; some, such as the newly industrialized countries, have very low wages compared to the United States. Since our competitiveness on the wage front is therefore limited, we must concentrate our competitive drive on fostering high rates of growth in productivity, which in turn depend upon the investment that our saving finances. The capital intensity of the U.S. corporate sector is illustrated in Table 2. In 1999, the average worker had $191,547 worth of fixed assets (equipment and structures) with which to work.

Table 2

Capital Intensity of U.S. Corporations in 1999

|

Current-Cost Net Stock of Private Fixed Assets Per Employee*

|

|

| All industries |

$191,547.00

|

| Agriculture, forestry, fishing |

$314,730.20

|

| Mining |

$1,012,287.30

|

| Construction |

$21,403.20

|

| Manufacturing |

$95,413.00

|

| Transportation and public utilities |

$405,930.90

|

| Wholesale and retail trade |

$107,728.00

|

| Finance, insurance, and real estate |

$1,679,550.50

|

| Services |

$27,805.60

|

| *Based on 1999 data from the U.S. Department of Commerce. Sources: U.S. Department of Commerce, Bureau of Economic Analysis, National Income and Product Accounts (Washington, D.C.: U.S. Government Printing Office); and “Corporation Income Tax Returns,” 1997 Statistics of Income, Internal Revenue Service (Washington, D.C.: U.S. Government Printing Office). Prepared by the American Council for Capital Formation Center for Policy Research, June 14, 2001. |

|

As with past generations, one of our major responsibilities is to lay a strong economic base for future generations. The U.S. tax code treats saving and investment very harshly and thus hampers our ability to maintain the strong economic base that will be needed in the coming years in the face of changing demographics and geopolitics. In addition, our tax code hits saving and investment harder than those of many of our international competitors. The foreign-source income of U.S. multinationals is also subject to higher taxes than that of many of our competitors. All of these factors should be of increasing concern to U.S. policymakers as globalization continues.

Tax reform can be carried out through a broad-based restructuring in which consumption, rather than income, becomes the tax base, or through incremental changes to the current income tax base that reduce the tax burden on various types of saving and investment. Either type of tax restructuring would enhance U.S. productivity and economic growth and promote the achievement of environmental goals. As Congress and the Bush Administration shape reforms to the U.S. tax code, strong consideration should be given to reducing taxes on saving and investment.

Before considering optional tax structures that promote competitiveness, economic growth, and retirement security, we would like to set out the intellectual framework for such a plan by first discussing the impact of the current U.S. tax code on saving and investment.

Taxes on Business Investment

Economists are in broad agreement that capital cost for investment is significantly affected by tax policy. The “user cost of capital” is the pretax rate of return on a new investment that is required to cover the purchase price of the asset, the market rate of interest, and other factors including inflation, risk, economic depreciation, and taxes. This capital cost concept is often called the “hurdle rate” because it measures the return an investment must yield before a firm would be willing to start a new capital project.

Stanford University Professor John Shoven, an internationally renowned public finance scholar, estimates that in the United States about one-third of the cost of capital is due to taxes. In other words, hurdle rates are 50 percent higher than they otherwise would be because of the tax liability on the income produced by the investment. Other scholars, such as Dr. Kevin Hassett of the American Enterprise Institute, conclude that taxes are about 10 percent of capital costs.2 While top public finance scholars debate the size of the impact of taxes on capital costs, all agree that taxes are a significant component of the user cost of capital. Quite clearly, therefore, higher taxes on new investment lead to less investment.

International Comparison of Taxes on Domestic- and Foreign-Source Investment

Several measures show that the United States taxes new investment more heavily than most of our international competitors. For example, according to a study by the centrist Progressive Policy Institute (the research arm of the Democratic Leadership Council), the effective tax rate on domestic U.S. corporate investment is 37.5 percent, exceeding that of every country in the survey except Canada (see Figure 1).3 The tax rate calculations include the major features of each country’s tax code, including individual and corporate income tax rates, depreciation allowances, and whether the corporate and individual tax systems are integrated.

Figure 1

Tax rates on foreign-source investment, which are indicators of how much encouragement domestic firms are given to enhance their economic viability by expanding operations abroad, again show the United States falling behind. The U.S. tax rate is 43.2 percent versus an average of 36.7 percent in the other G-7 countries (see Figure 2).

Figure 2

The disadvantages that U.S. firms face when competing in global markets is further illustrated by a 1997 study sponsored by the ACCF Center for Policy Research, which shows that U.S. financial service firms face much higher tax rates on foreign-source income than do their international competitors when operating in a third country such as Taiwan (see Figure 3). A 12-country analysis shows that U.S. insurance firms are taxed at a rate of 35 percent on income earned abroad compared to 14.3 percent for French-, Swiss-, or Belgian-owned firms. As a consequence of their more favorable tax codes, foreign financial service firms can offer products at lower prices than can U.S. firms, thereby giving them a competitive advantage in world markets.

Figure 3

International Comparison of Depreciation Allowances

Prior to the 1986 Tax Reform Act (TRA ’86), the United States had one of the best capital cost recovery systems in the world. For example, the present value of the deductions for investing in machinery to produce computer chips and in modern casting equipment for steel production was close to 100 percent under the strongly pro-investment tax regime in effect from 1981 to 1985, according to a study by Arthur Andersen & Co. In contrast, under current law the present value of the capital cost recovery allowance for that same investment for computer chips is only 85 percent and for continuous casting equipment is only 81 percent (see Table 3).

Table 3

International Comparison of the Present Value of Equipment Used to Make Selected Manufacturing Products and Pollution Control Equipment

The Arthur Andersen study also shows that the United States lags behind many of our major competitors in capital cost recovery for technologically innovative equipment, which is crucial to U.S. economic strength and helps prevent pollution. Capital cost recovery provisions for pollution-control equipment are much less favorable now than prior to TRA ’86. For example, the present value of cost recovery allowances for wastewater treatment facilities used in pulp and paper production was approximately 100 percent before TRA ’86 (see Table 3). Under TRA ’86, the present value for wastewater treatment facilities dropped to 81 percent. Allowances for scrubbers used in the production of electricity were 90 percent before TRA ’86; the present value fell to 55 percent after TRA ’86. As is true in the case of productive equipment, both the loss of the investment tax credit and the lengthening of depreciable lives enacted in TRA ’86 raised effective tax rates on new investment in pollution control and energy-efficient equipment. Slower capital cost recovery means that equipment embodying new technology and energy efficiency will not be put in place as rapidly as it would be under a more favorable tax code.

Impact of U.S. Tax Code Changes on Effective Tax Rates

A new analysis by Harvard University Professor Dale Jorgenson and Yonsei University Professor Kun-Young Yun documents the significant increase in the effective tax rate faced by most assets after the passage of TRA ’86. 4 This new study finds that in 1982, after the enactment of the 1981 Economic Recovery Tax Act, producers’ durable equipment had the equivalent of expensing a first-year write-off (see Table 4) with a zero effective tax rate. Passage of TRA ’86 raised the effective tax rate from zero to 32 percent. By 1996, the rate had risen to 36 percent due to income tax rate increases.

Table 4

Effective Federal Tax Rate on Business Assets

|

Producers’ Durable Equipment

|

Nonresidential Structures

|

Residential Structures

|

Inventories and Land

|

All Assets

|

|

| 1981 |

35%

|

50%

|

38%

|

56%

|

47%

|

| 1982 |

0%

|

27%

|

28%

|

56%

|

31%

|

| 1987 |

32%

|

31%

|

27%

|

44%

|

36%

|

| 1996 |

36%

|

39%

|

31%

|

46%

|

40%

|

| Source: Dale W. Jorgenson and Kun-Young Yun, Investment Volume 3: Lifting the Burden: Tax Reform, the Cost of Capital, and U.S. Economic Growth (Cambridge, Mass.: MIT Press, 2001) | |||||

Taxes on Capital Gains

U.S. capital gains tax rates, which affect the cost of capital and therefore investment and economic growth, are still high compared to those of other countries. In fact, most industrial and developing countries tax individual and corporate capital gains more lightly than does the United States, according to a 1998 survey of 24 industrialized and developing countries that the ACCF Center for Policy Research commissioned from Arthur Andersen LLP.

Table 5

International Comparison of Individual Capital Gains: Maximum Federal Tax Rates on Equities

|

Country

|

Maximum. Individual. Tax Rate

|

Individual Capital Gains: Maximum Federal Tax Rates on Equities

|

Individual Holding Period

|

|

|

Short-term

|

Long-term

|

|||

| Argentina | 33 | Exempt | Exempt | No |

| Australia | 48.5 | 24 | 24 | No |

| Belgium | 56.7 | Exempt | Exempt | No |

| Brazil | 27.5 | 15 | 15 | No |

| Canada | 31.3 | 14.5 | 14.5 | No |

| Chile | 45 | 45.0; annual exclusion of $6,600) | 45.0; annual exclusion of $6,600) | No |

| China | 45 | 20.0; shares traded on major exchange exempt | 20.0; shares traded on major exchange exempt | No |

| Denmark | 61.7 | 40 | 40.0; shares valued at less than $16,000 exempt if held 3+ years | Yes, 3 years1 |

| France | 58.1 | 26.0; annual exclusion of $8,315 | 26.0; annual exclusion of $8,315 | No |

| Germany | 55.9 | 55.9 | Exempt | Yes, 6 months |

| Hong Kong | 20.02 | Exempt | Exempt | No |

| India | 30 | 30 | 20 | Yes, 1 year |

| Indonesia | 30 | 0.1 | 0.1 | No |

| Italy | 46 | 12.5 | 12.5 | No |

| Japan | 50 | 1.25% of sales price or 20.0% of net gain | 1.25% of sales price or 20.0% of net gain | No |

| Korea | 40 | 20.0; shares traded on major | 20.0; shares traded on major | No |

| Mexico | 35 | Exempt | Exempt | No |

| Netherlands | 60 | Exempt | Exempt | No |

| Poland | 40 | Exempt | Exempt | No |

| Singapore | 28 | Exempt | Exempt | No |

| Sweden | 57 | 30 | 30 | No |

| Taiwan | 40 | Exempt (local company shares) | Exempt (local company shares) | No |

| United Kingdom | 40 | 40.0; shares valued at less than $11,225 exempt | 40.0; shares valued at less than $11,225 exempt | Yes, 1 to 10 years3 |

| United States | 38.6 | 38.6 | 20 | Yes, 1 year4 |

| Average | 42.4 | 17.2 | 14.5 | 79.2% have no holding period |

| Notes: 1 Gains on shares held three or more years are tax exempt if taxpayer owns less than US $16,000 of the company’s shares. 2 Maximum marginal tax rate is 20 percent for the assessment year 1997/1998 and 17 percent for 1998/1999. 3 Sliding scale of rates applies to 1 to 10 years of ownership through an exclusion that rises gradually to 75 percent for assets held 10 or more years. Thus, assets held 10 or more years face a top marginal rate of 10 percent. 4 Shares held 12 months or more are taxed at a rate lower than that on ordinary income under the IRS Restructuring and Reform Act of 1998. Source: ACCF Center for Policy Research, Washington, D.C., updated February, 2001. |

||||

Both short- and long-term individual capital gains on equities are taxed at higher rates in the United States than in most of the other 23 countries surveyed. Short-term gains are taxed at 38.6 percent in the United States compared to an average of 17.2 percent for the sample as a whole. Long-term gains face a tax rate of 20 percent in the United States versus an average of 14.5 percent for all the countries in the survey (see Table 5). Thus, U.S. individual taxpayers face tax rates on long-term gains that are 38 percent higher than those paid by the average investor in other countries. In addition, the United States is one of only five countries surveyed with a holding period requirement in order for the investment to qualify as a capital asset.

Similarly, short- and long-term corporate capital gains tax rates are higher in the United States than in most other industrial and developing countries surveyed. Both short- and long-term gains are taxed at a maximum rate of 35 percent in the United States, compared to an average of 22.5 percent for short-term gains and 19.3 percent for long-term gains in the sample as a whole (see Table 6). In other words, U.S. corporations face long-term capital gains tax rates 80 percent higher than those of all but one of the other countries surveyed. (Germany’s rate [45 percent] is scheduled to drop to zero in 2002.) Only four of the 24 countries surveyed impose a holding period in order to be eligible for preferential corporate capital gains tax rates.

Table 6

International Comparison of Corporate Capital Gains: Maximum Federal Tax Rates on Equities

|

Country

|

Corporate Capital Gains: Maximum Federal Tax Rates on Equities

|

Corporate Holding Period

|

|

|

Short-term

|

Long-term

|

||

| Argentina | 33 | 33 | No |

| Australia | 30.0; phased in over 2 years | 30.0; phased in over 2 years | No |

| Belgium | Exempt | Exempt | No |

| Brazil | 33 | 33 | No |

| Canada | 21.8 | 21.8 | No |

| Chile | 15 | 15.0; asset cost is indexed | No |

| China | 33.0; shares traded on major exchange exempt | 33.0; shares traded on major exchange exempt | No |

| Denmark | 34 | Exempt1 | Yes, 3 years |

| France | 41.7 | 23.8 | Yes, 2 years |

| Germany | 45 (drops to zero in 2002) | 45 (drops to zero in 2002) | No |

| Hong Kong | Exempt | Exempt | No |

| India | 35 | 20.02 | Yes, 1 year |

| Indonesia | 0.13 | 0.13 | No |

| Italy | 37 | 27.04 | Yes, 3 years |

| Japan | 34.5 | 34.5 | No |

| Korea | 20.0; shares traded on major exchange exempt | 20.0; shares traded on major exchange exempt | No |

| Mexico | 34 | 34 | No |

| Netherlands | Exempt | Exempt | No |

| Poland | Exempt | Exempt | No |

| Singapore | Exempt | Exempt | No |

| Sweden | 28 | 28 | No |

| Taiwan | Exempt (local company shares) | Exempt (local company shares) | No |

| United Kingdom | 31.05 | 31.05; asset cost is indexed | No |

| United States | 35 | 35 | No |

| Average | 22.5 | 19.3 | 83% have no holding period |

| Notes: 1 For corporations, capital gains are tax exempt if the holding period is longer than three years. 2 Capital gains from sale of equity investments and securities listed on stock exchange and held for more than one year are taxed at 20 percent. 3 An additional tax of 0.5 percent applies to the disposition of founder shares (effective as of May 29, 1997). In this case, if the taxpayer does not want to use the facility of 0.5 percent, the normal progressive tax rate of 30 percent is applied. 4 For corporations, a substitute tax of 27 percent applies on capital gains arising from the transfer of shares held and accounted for as financial assets for at least three years. 5 The corporate rate will be reduced to 30 percent effective from April 1999. Source: ACCF Center for Policy Research, Washington, D.C., updated February, 2001. |

|||

Capital gains tax reductions would have a positive impact on capital costs. For example, the Taxpayer Relief Act of 1997 reduced the individual capital gains tax from a top rate of 28 percent to 20 percent. The capital gains tax cut reduced the net cost of capital for new investment by about 3 percent, according to a macroeconomic analysis prepared by Dr. David Wyss, chief economist of Standard & Poor’s DRI and a top public finance expert.

Table 7

Economic Impact of the 1997 Capital Gains Tax Reduction

| (compared to the baseline forecast) |

Total 1998–2009

|

| Real GDP (% increase by 2009) |

0.4

|

| Investment (% per year increase) |

1.5

|

| Capital stock (% difference by 2009) |

1.2

|

| Productivity (% increase by 2009) |

0.4

|

| Cost of capital (% difference) |

-3

|

| Total federal tax receipts (billions of 1997 dollars) |

$5.0

|

| Source: Capital Gains Taxes and the Economy: A Retrospective Look, June, 1999. Standard & Poor’s DRI, Lexington, Mass. | |

Dr. Wyss’s study shows that reducing capital costs will, other things being equal, raise business investment by 1.5 percent per year (see Table 7). Over a 10-year period, the capital stock will rise by 1.2 percent, and productivity and real GDP will increase by 0.4 percent relative to the baseline forecast. This productivity increase allows living standards to rise; for example, U.S. household income will be $309 higher each year and the average worker’s real wages will be $250 higher in 2007 and in each succeeding year (see Figure 4).

Figure 4

In addition, a significant share of the increase in stock prices since 1997 (about 25 percent) is due to lower taxes on individual capital gains (see Figure 5). Lowering capital gains taxes increases the after-tax rate of return on equities. Their stock prices must rise to re-equilibrate the risk adjusted after-tax return with the rate available on other assets such as bonds.

Figure 5

Many policy experts in the U.S. Congress, academic institutions, and think tanks conclude that further reductions in federal taxes on individual as well as corporate capital gains will enhance U.S. saving, investment, and GDP growth as well as provide a much needed boost to equity value. For example, an analysis of the capital gains tax reductions included in the Taxpayer Refund and Relief Act of 1999 (H.R. 2488) by Dr. Allen Sinai, chief global economist, Primark Decision Economics, shows that an immediate reduction in the individual long-term rates from 20/10 percent to 18/8 percent would have a significant, positive impact. (H.R. 2488 was vetoed by President Clinton in September 1999.)

Dr. Sinai’s analysis indicates that if the rate reductions in H.R. 2488 had been enacted, real GDP would be $64.6 billion higher, and employment, investment, new business formation, and national saving would be greater over the 2000–2004 period compared to the baseline forecast (see Table 8). In addition, U.S. capital costs would be slightly lower. He concludes that the capital gains tax cut would have produced a “significant bang for the buck.”

Table 8

Cumulative Impact of Capital Gains Tax Reductions in H.R. 2488, the Taxpayer Refund and Relief Act of 1999

| (Compared to baseline forecast) |

FY 2000–2004

|

| Real GDP (billions of 92$) |

$64.60

|

| (average change per year in GDP growth rate) |

0.10%

|

| Employment | |

| (average change per year) |

112,000

|

| Real business capital spending | |

| Total (billions of 92$) |

$18.20

|

| Equipment |

$17.20

|

| Structures |

$2.00

|

| New Business Incorporations |

200,000

|

| Cost of capital | |

| Pretax return required by an investor (average change per year) |

-0.13%

|

| S&P Stock Index | |

| (average change per year) |

0.80%

|

| National Saving | |

| (billions of dollars) |

$84.20

|

| Notes: H.R. 2488 included a capital gains tax reduction from 20/10 percent to 18/8 percent. Source: Data from Dr. Allen Sinai, president and chief global economist, Primark Decision Economics, Inc., December, 1999. |

|

Taxes at Death

While the death tax reforms included in the Economic Growth and Tax Relief Reconciliation Act of 2001 are somewhat helpful, faster repeal of the death tax is very desirable. (Under the new law, the top death tax rate drops from 55 percent to 45 percent in 2007 and is repealed entirely in 2010. The unified credit is also gradually increased from $1 million in 2002 to $3.5 million in 2009.) Many top academic scholars and policy experts conclude that the U.S. federal estate tax should be repealed or reduced much faster than the new law provides because the death tax adds to the already heavy U.S. tax burden on saving and investment. For example, analysis by MIT’s Professor James Poterba shows that the U.S. estate tax can raise the cost of capital by as much as 3 percent.5 The estate tax also makes it harder for family businesses, including farms, to survive the death of their founders.

According to a recent analysis by Dr. Douglas Holtz-Eakin, now chief economist of the President’s Council of Economic Advisers (previously chairman of the department of economics at Syracuse University), the federal estate tax has a negative impact on entrepreneurial activity because entrepreneurs face significantly higher average and marginal tax rates on the investments they make.6 Entrepreneurs also face higher capital costs due to the estate tax (see Figure 6). Dr. Holtz-Eakin’s study shows that the estate tax reduces the labor supply. He estimates that eliminating the estate tax would raise employment by 170,000 jobs and would increase saving by $800–$3,000 per person per year. Increased saving would permit higher levels of investment.

Figure 6

Another study, prepared by Dr. Allen Sinai using his large-scale econometric model, shows that estate tax repeal/reform would have a positive impact on the U.S. economy.7 Dr. Sinai estimates the impact of five different reform and repeal options, including 1) immediate repeal coupled with elimination of the step-up in basis; 2) immediate repeal of the estate tax with step-up in basis retained; 3) phase out of the estate tax over eight years; 4) reduction of the top estate tax rate from 55 percent to 20 percent (the highest capital gains tax rate); and 5) reduction in the top estate tax rate from 55 percent to 39.6 percent (the top individual income tax rate prior to passage of the Economic Growth and Tax Relief Reconciliation Act of 2001).

The results suggest the following effects from immediate elimination or reform of the estate tax, retroactive to January 1, 2001. GDP increases a cumulative $90 billion to $150 billion over the 2001–2008 period, or 0.1 percent to 0.2 percent compared with the baseline for several of the eight years in the preliminary runs (see Table 9). Job growth ranges from 80,000 to 165,000 per year and the unemployment rate slightly lowers as a result (by 0.1 percent), with essentially no change in the inflation rate. Both consumption and personal saving rise, as does national saving, despite the loss in estate tax receipts to the federal government. The level of potential output is somewhat higher, by an average $6 billion to $9 billion per year. Tax receipts, excluding estate tax receipts, rise in response to the stronger economy and financial system, feeding back approximately $0.20 per dollar of estate tax reduction, helping to pay for the estate tax reduction. One option—immediate repeal combined with the elimination of step-up in basis—increases total federal tax receipts by almost $55 billion over the 2001–2008 period compared to the baseline forecast because of the tax saving from elimination of step-up and the increase in capital gains realizations (see Table 9). The results of Dr. Sinai’s analysis suggest that death tax repeal could be a useful component of a near-term economic stimulus package as well as a positive step toward pro-growth, fundamental tax reform.

Table 9

Impact of Estate Tax Repeal/Reform on U.S. Economic Growth, 2001–2008

|

(Changes from baseline, cumulative except as otherwise noted)

|

Immediate Repeal, Loss of Step-up

|

Immediate Repeal, Step-up Retained

|

8-Year Phaseout

|

Lower Top Rate From 55% to 20%

|

Lower Top Rate From 55% to 39.6%

|

| Real GDP | |||||

| (billions of 1996 dollars) |

$131.60

|

$149.40

|

$103.20

|

$124.30

|

$88.20

|

| Employment | |||||

| (average difference in levels per year) |

164,761

|

132,443

|

94,311

|

113,647

|

80,521

|

| New Business Incorporations | |||||

| (average difference in levels per year) |

45,736

|

261,181

|

130,859

|

188,929

|

145,427

|

| Total Federal Tax Receipts | |||||

| (fiscal years) |

$54.30

|

($211.30)

|

($110.40)

|

($108.80)

|

($37.00)

|

| Note: Assumes the saving in taxes paid is treated as an increase in disposable income as opposed to reinvesting in assets or paying down debt. Under different assumptions about how the tax savings is taken, the quantitative estimates might change but the direction of the results would not. Source: “Macroeconomic Effects of the Elimination of the Estate Tax,” by Allen Sinai, chief global economist and president, Decision Economics, Inc., preliminary report prepared for the American Council for Capital Formation Center for Policy Research, Washington, D.C., March, 2001. |

|||||

Taxes on Interest and Dividends

Interest and dividends received by individuals also are taxed more heavily in the United States than in many other countries, according to a 1998 Arthur Andersen survey of 24 countries. High tax rates on dividends and interest raise the cost of capital for new investment and slow U.S. economic growth. The top marginal income tax rate is 38.6 percent in the United States compared to an average of 32.4 percent in the countries surveyed as a whole. Nearly 40 percent of the countries surveyed tax interest income at a lower rate than ordinary income; for example, Italy taxes ordinary income at a top rate of 46 percent while its top tax rate on interest income is only 27 percent.8

In several countries surveyed, small savers receive special encouragement in the form of lower taxes or exemptions on a portion of the interest they receive. For example, in Germany, the first $6,786 of interest income for married couples filing a joint return ($3,393 for singles) is exempt from tax; in Japan, interest on saving up to $26,805 is exempt from tax for individuals older than 65; in the Netherlands, the first $987 of interest income for married couples ($494 for singles) is exempt from tax; and in Taiwan, the first $8,273 of interest received from local financial institutions is exempt from tax.

Similarly, dividend income is also taxed more heavily in the United States than in the other countries surveyed. The U.S. tax rate is 60.4 percent (combined corporate and individual tax on dividend income) compared to an average of 51.1 percent in the surveyed countries as a whole. Of the countries surveyed, 62.5 percent offset the double taxation of corporate income (the income is taxed at the corporate level and again when distributed in the form of dividends) by providing either a lower tax rate on dividend income received by a shareholder or by providing a corporation with a credit for taxes paid on dividends distributed to their shareholders.

In the case of dividends received, small savers receive preferential treatment in about one-fourth of the countries surveyed. In France, for example, the first $2,661 of dividends on French shares received by a married couple is exempt from tax ($1,330 for singles); in the Netherlands, the first $987 of dividend income for married couples ($494 for singles) is exempt from tax; and in Taiwan, the first $8,273 of dividends from local companies is exempt from tax.

Recent Evidence on the Impact of Tax Policy on Economic Growth

Do we favor a truly level playing field over time to encourage saving and investing, stimulate economic growth, and create new and better jobs? If so, then we should not tax savings (including capital gains) at all. This view was held by top economists in the past and is held by many mainstream economists today.

Tax reform is necessary to encourage saving because the income tax hits saving more than once—first when income is earned, and again when interest and dividends on investment are received, or when capital gains from investment are realized. The playing field is tilted away from saving and investment because individuals and companies who save and invest pay more taxes over time than if they consumed all their income and no saving took place. Taxes on income that is saved raise the capital costs of new productive investment for both individuals and corporations, thus dampening such investment. As a result, future growth in output and living standards is impaired.

Several new analyses by academic scholars and government policy experts suggest that substituting a broad-based consumption tax for the current federal income tax could have a positive impact on economic growth and living standards. The macroeconomic models used by the scholars in these studies incorporate feedback and dynamic effects in stimulating the impact of adopting either a broad-based consumption tax or a “pure” income tax.

For example, in “Stimulating U.S. Tax Reform,” Professors Alan Auerbach of the University of California and Laurence J. Kotlikoff of Boston University, Drs. Kent A. Smetters and Jan Walliser of the Congressional Budget Office (CBO), and David Altig of the Federal Reserve Bank of Cleveland analyze the impact of fundamental tax reform on equity, efficiency, and economic growth.9

The authors use a general equilibrium model developed by Professors Auerbach and Kotlikoff to examine five tax reforms spanning the major proposals now under discussion. Each of the reforms replaces the federal personal and corporate income taxes, and each is simulated assuming the same growth-adjusted levels of government spending and government debt. The reforms are a “ clean” income tax and four types of consumption taxes. These consumption taxes are: a) a “clean” consumption tax; b) a Hall-Rabushka flat tax; c) a Hall-Rabushka flat tax with transition relief; and d) Princeton University Professor David Bradford’s “X tax.”

The clean income tax eliminates all personal exemptions and deductions, and taxes labor and capital income at a single rate. The clean consumption tax differs from the clean income tax by permitting expensing of new investment (meaning that the total cost of the investment is deducted in the first year). This tax is implemented as a tax on wages with all saving exempt from tax at the household level, and as a cash-flow tax on business.

The Hall-Rabushka flat tax differs from the consumption tax by including a standard deduction against wage income and by not taxing the rental value of owner-occupied housing and the value of services provided by consumer durables. The flat tax with transition relief permits continued depreciation of capital in existence as of the reform. Finally, the Bradford X tax combines a progressive wage tax with a business cash-flow tax where the business cash-flow tax rate equals the highest tax rate applied to wage income.

Auerbach et al. conclude that switching to a consumption tax can offer significant economic gains. The Bradford X tax, which the authors give the highest marks for its impact on equity, efficiency, and economic growth, raises long-term output by 7.5 percent and provides no transition relief from its expensing provisions. It also hits the rich with higher marginal tax rates than the poor. It is not surprising, then, that in the long run the X tax helps those who are poor by more than it helps those who are rich. Still, under the X tax there are no long-run losers; even the rich are better off. Transition relief and adjustments that prevent adverse distributional effects lessen the positive impact of tax reform on the economy.

Another study, the Joint Committee on Taxation’s “Tax Modeling Project and 1997 Tax Symposium Papers,” summarizes the results of a number of scholars who compared the macroeconomic consequences of a broad-based unified income tax (a “clean” income tax in Auerbach’s terminology) to those of a broad-based consumption tax.10 Participants included Roger E. Brinner, DRI/McGraw-Hill; Eric M. Engen, Federal Reserve Board of Governors; Jane G. Gravelle, Congressional Research Service; Dale W. Jorgenson, Harvard University; Laurence J. Kotlikoff, Boston University; Joel L. Prakken, Macroeconomic Advisers; Gary Robbins, Fiscal Associates; Diane Lim Rogers, CBO; Kent A. Smetters, CBO; Peter J. Wilcoxen, Unversity of Texas; John G. Wilkens, Coopers & Lybrand; and Jan Walliser, CBO.

The economic impact of a “pure” income tax compared to a “ pure” consumption tax is shown in Table 10. The effects of the consumption tax proposals on GDP are generally positive over the medium and long terms, although the magnitude of these effects varies widely. For example, the Jorgenson-Wilcoxen model predicts that under a consumption tax, real GDP would be 3.3 percent higher each year in the long run compared to 1.3 percent higher under a unified income tax (see Table 10). The Auerbach, Kotlikoff, Smetters, and Walliser model predicts even greater gains in the long run (7.5 percent) under a consumption tax and losses (-3.0 percent of GDP) under a unified income tax. Similarly, the Engen-Gale analysis shows that the capital stock would be 9.8 percent higher in the long run under a consumption tax but 1.6 percent smaller under a unified income tax. The consensus seems to be that the economy would fare better under a “pure” consumption tax than under a “pure” income tax or under current law.

In still another recent report, “The Economic Effects of Comprehensive Tax Reform,” the Congressional Budget Office (CBO) analyzes the effect of switching from the federal income tax to a comprehensive consumption-based tax, using a general equilibrium model developed by University of Texas’s Don Fullerton and Diane Lim Rogers of CBO.11 CBO’s analysis shows that substituting a broad-based consumption tax for an income tax would probably increase national saving and ultimately raise the living standards of future generations. It would increase the capital stock and raise the level of national output by between 1 percent and 10 percent, although CBO concludes that increases at the upper end of the range are unlikely.

The reform might be expected to increase economic efficiency as well as output for a number of reasons, according to the CBO study. First, the switch to a consumption base would eliminate the influence of taxes on the timing of consumption. Second, the new system might treat different sources of income more uniformly by including more of them in the tax base and subjecting all of them to similar tax rates. Third, a broader base would allow lower overall marginal tax rates, reducing the amount by which taxes affect relative prices and hence all kinds of economic decisions. CBO notes, however, that efficiency is not the only criterion to use in judging the desirability of tax reform. Administrative and compliance costs are other important factors. If a consumption tax offered substantial gains from reduced complexity, then even a minimal gain in economic efficiency would be an added bonus.

Table 10

Impact of Tax Reform on GDP and Capital Stock Growth

| (Percent differences from current tax code baseline) |

Consumption Tax

|

Unified Income Tax

|

||||

| Summary variables |

2005

|

2010

|

Long run

|

2005

|

2010

|

Long run

|

| REAL GDP: | ||||||

| Fullerton-Rogers—low1 |

—

|

—

|

1.7

|

—

|

—

|

1.8

|

| Fullerton-Rogers—high2 |

—

|

—

|

5.8

|

—

|

—

|

3.8

|

| Auerbach, Kotlikoff, Smetters, & Walliser |

4

|

5

|

7.5

|

-1.7

|

-2.1

|

-3

|

| Engen-Gale |

1.8

|

2.1

|

2.4

|

-0.2

|

-0.3

|

-0.5

|

| Jorgenson-Wilcoxen |

3.6

|

3.3

|

3.3

|

1.6

|

1.4

|

1.3

|

| Macroeconomic Advisers (transition relief) |

1.4

|

1.3

|

5.4

|

—

|

—

|

—

|

| Robbins |

16.4

|

16.9

|

—

|

14.6

|

15.4

|

—

|

| DRI Inc./McGraw-Hill |

4.7

|

—

|

—

|

-1.1

|

—

|

—

|

| DRI Inc./McGraw-Hill—“VAT” |

-4.2

|

—

|

—

|

—

|

—

|

—

|

| Gravelle |

0.7

|

1

|

3.7

|

0.6

|

0.7

|

1.8

|

| Coopers & Lybrand |

1.2

|

—

|

—

|

1.1

|

—

|

—

|

| CAPITAL STOCK: | ||||||

| Fullerton-Rogers—low1 |

—

|

—

|

5.2

|

—

|

—

|

5.4

|

| Fullerton-Rogers—high2 |

—

|

—

|

23.8

|

—

|

—

|

11.8

|

| Auerbach, Kotlikoff, Smetters, & Walliser |

14

|

19.1

|

31.5

|

-4.2

|

-5.9

|

-10.5

|

| Engen-Gale |

7

|

7.6

|

9.8

|

-0.7

|

-1

|

-1.6

|

| Jorgenson-Wilcoxen |

0.9

|

0.6

|

0.3

|

-2

|

-2.3

|

-2.6

|

| Macroeconomic Advisers (transition relief) |

4.3

|

4.8

|

13.2

|

—

|

—

|

—

|

| Robbins |

47

|

57.2

|

—

|

38.8

|

48.6

|

—

|

| DRI Inc./McGraw-Hill |

13.7

|

—

|

—

|

-1.5

|

—

|

—

|

| DRI Inc./McGraw-Hill—“VAT” |

-0.7

|

—

|

—

|

—

|

—

|

—

|

| Gravelle |

1.7

|

2.7

|

11.2

|

0.5

|

0.9

|

4.1

|

| Coopers & Lybrand |

1.5

|

—

|

—

|

1.1

|

—

|

—

|

| Notes: 1. Assumes leisure-consumption (intratemporal) and intertemporal elasticities both are 0.15. 2. Assumes leisure-consumption (intratemporal) and intertemporal elasticities both are 0.50. Source: Adapted from Joint Committee on Taxation, “Tax Modeling Project and 1997 Tax Symposium Papers,” November 20, 1997. |

||||||

Figure 7

Another relatively recent study, ‘Taxation and Economic Growth,” by Eric M. Engen of the Federal Reserve Board of Governors and Professor Jonathan Skinner of Dartmouth College, examines evidence on taxation and growth for a large sample of countries.12 The type of tax system a country chooses significantly affects that nation’s prospects for long-term economic growth, according to Engen and Skinner. Figures 7 and 8 show the correlation between income taxes and economic growth and between consumption taxes and economic growth over the period 1965–1991 in countries of the Organization for Economic Cooperation and Development (OECD). The authors note that these scatter plots, largely confirmed in regression analysis, suggest that income taxation is more harmful to growth than broad-based consumption taxes. Engen and Skinner’s study also suggests that tax policy does affect economic growth and that lower tax rates do enhance economic growth. For example, a major tax reform plan which reduces marginal tax rates by 5 percentage points will increase growth by 0.2 to 0.3 points.

Figure 8

Even modest growth effects can have an important long-term impact on living standards, Engen and Skinner note. For example, suppose that inefficiency in the structure of taxation has, since 1960, retarded growth by 0.2 percent annually. Accumulated over the past 36 years, the lower growth rate translates to a 7.5 percent lower level of GDP in 1996, or a net reduction in output of more than $500 billion annually. Thus, the potential effects of tax policy, although difficult to detect in the time-series data, can have very large effects over the long term.

A recent survey by Dr. Kevin Hassett of the American Enterprise Institute, Tax Policy and Investment,13 notes that elasticity of investment with respect to the user cost of capital is between -0.5 and -1.0. He notes that the “range of estimated responses of investment to tax parameters is well above the consensus of only a few years earlier and suggests that investment tax policy can significantly affect the path of aggregate capital formation.” His results show that the value of the tax wedge under current law is 1.148 and the user cost of capital is 0.234. If the United States adopted a consumption tax, Hassett concludes, the user cost of capital would fall to 0.205, which would lead to about a 10 percent increase in equipment investment.

Table 11

Economic Impact on the United States of Switching to a Consumption Tax in 1991

| Expensing business investment, removal of the business and personal interest deduction, and tax exemption of savings |

Average

1991-1995 |

Average

1996-2000 |

Average

2001-2004 |

| Real GDP—level (billions of $96) | |||

| Base |

7,085.80

|

8,499.60

|

10,113.10

|

| Simulation of consumption tax |

7,203.20

|

8,890.00

|

10,637.70

|

| (Difference in level) |

117.5

|

390.5

|

524.6

|

| (Percent change in level) |

1.70%

|

4.60%

|

5.20%

|

| Real GDP-Growth (percentage points), Base |

2.3

|

4.4

|

3.3

|

| Real GDP-Growth (percentage points), | |||

| Simulation of consumption tax |

2.8

|

4.8

|

3.5

|

| Difference |

0.5

|

0.5

|

0.2

|

| Business capital spending, total (billions of $96) | |||

| Base |

684.2

|

1,092.00

|

1,599.60

|

| Simulation of consumption tax |

824.9

|

1,495.60

|

2,168.80

|

| (Difference in level) |

140.7

|

403.5

|

569.2

|

| (Percent change in level) |

20.60%

|

37.00%

|

35.60%

|

| Plant, base |

203.4

|

248

|

311

|

| Plant, simulation of consumption tax |

228.6

|

303.1

|

369.7

|

| (Difference in level) |

25.2

|

55.1

|

58.7

|

| (Percent change in level) |

12.40%

|

22.20%

|

18.90%

|

| Equipment, base |

484.1

|

845.5

|

1,325.20

|

| Equipment, simulation of consumption tax |

590.6

|

1,180.20

|

1,832.30

|

| (Difference in level) |

106.5

|

334.7

|

507.1

|

| (Percent change in level) |

22.00%

|

39.60%

|

38.30%

|

| Capital formation, total (billions of $96) | |||

| Plant | |||

| Plant, base |

4,942.50

|

5,340.70

|

5,881.90

|

| Plant, simulation of consumption tax |

4,989.40

|

5,584.70

|

6,347.60

|

| (Difference in level) |

46.9

|

243.9

|

465.7

|

| (Percent change in level) |

0.90%

|

4.60%

|

7.90%

|

| Equipment | |||

| Equipment, base |

2,891.50

|

3,628.50

|

5,048.70

|

| Equipment, simulation of consumption tax |

3,054.40

|

4,532.90

|

6,784.00

|

| (Difference in level) |

162.9

|

904.4

|

1,735.20

|

| (Percent change in level) |

5.6

|

24.9

|

34.4

|

| Consumption (billions of $96) | |||

| Base |

4,761.70

|

5,717.20

|

6,746.30

|

| Simulation of consumption tax |

4,773.30

|

5,843.40

|

7,021.50

|

| (Difference in level) |

11.6

|

126.1

|

275.3

|

| (Percent change in level) |

0.2

|

2.2

|

4.1

|

| Net exports (billions of $96) | |||

| Base |

-54.2

|

-225.6

|

-397.4

|

| Simulation of consumption tax |

-99.3

|

-422.7

|

-872.4

|

| (Difference in level) |

-45

|

-197.1

|

-475

|

| Inflation (annual percent change) | |||

| GDP Chain Price Index, base |

2.60%

|

1.80%

|

2.30%

|

| GDP Chain Price Index, simulation of consumption tax |

2.50%

|

2.30%

|

2.50%

|

| Difference |

-0.10%

|

0.50%

|

0.20%

|

| Consumer Price Index (All Urban), base |

3.10%

|

2.40%

|

2.30%

|

| Consumer Price Index (All Urban), simulation of consumption tax |

2.90%

|

2.60%

|

1.90%

|

| Difference |

-0.30%

|

0.20%

|

-0.40%

|

| S&P 500 Price Index | |||

| Base |

449.1

|

1081.9

|

1803.2

|

| Simulation of consumption tax |

557.4

|

1370.5

|

2123.4

|

| Difference |

108.4

|

288.6

|

320.2

|

| (Percent difference in level) |

24.10%

|

26.70%

|

17.80%

|

| S&P 500 Operating | |||

| Earnings per share | |||

| Base |

28.3

|

47.7

|

69.9

|

| Simulation of consumption tax |

34

|

65.2

|

83.2

|

| Difference |

5.8

|

17.5

|

13.4

|

| (Percent difference in level) |

20.40%

|

36.60%

|

19.10%

|

| Exchange Rate | |||

| Morgan Trade-Weighted Index, base |

0.974

|

1.062

|

1.045

|

| Morgan Trade-Weighted Index, | |||

| simulation of consumption tax |

1.028

|

1.087

|

1.06

|

| (Difference in level) |

0.054

|

0.025

|

0.016

|

| (Percent difference in level) |

5.55%

|

2.31%

|

1.52%

|

| Budget deficit (NIPA) (billions of dollars) | |||

| Base |

-172.7

|

92.7

|

223.4

|

| Simulation of consumption tax |

-273.6

|

76.6

|

320.1

|

| (Difference in level) |

-100.9

|

-16.1

|

96.7

|

| Personal savings | |||

| Base |

368.8

|

217.1

|

69.3

|

| Simulation of consumption tax |

343.8

|

228.8

|

122.4

|

| (Difference in level) |

-25

|

11.6

|

53.1

|

| Business savings | |||

| Base |

336.8

|

469.7

|

609.4

|

| Simulation of consumption tax |

266

|

782.8

|

871.6

|

| (Difference in level) |

-70.8

|

313.1

|

262.2

|

| National savings | |||

| Base |

668.6

|

998.3

|

1,225.40

|

| Simulation of consumption tax |

460.5

|

1,335.30

|

1,673.20

|

| (Difference in level) |

-208.1

|

336.9

|

447.9

|

| Employment (millions of persons) | |||

| Total payrolls, base |

111.773

|

125.771

|

138.45

|

| Total payrolls, simulation of consumption tax |

111.8

|

129.3

|

140.9

|

| (Difference in level) |

0.0

|

3.6

|

2.4

|

| Potential Output (billions of $96) | |||

| Base |

7202.9

|

8509.3

|

10185.6

|

| Simulation of consumption tax |

7420.6

|

8931.9

|

10818.4

|

| (Difference in level) |

217.7

|

422.6

|

632.9

|

| Productivity (annual percent change) | |||

| Nonfarm business, base |

1.5

|

2.7

|

2.3

|

| Nonfarm business, simulation of consumption tax |

2.6

|

2.8

|

2.8

|

| Difference |

1.1

|

0.1

|

0.5

|

| Source: Allen Sinai, “Macroeconometric Model Simulation With the Sinai-Boston Model of the U.S. Economy,” unpublished study, 2001. | |||

Furthermore, findings by Harvard’s Professor Jorgenson, described in his new book, Lifting the Burden: U.S. Tax Reform and Economic Growth, 14 show that switching from the income tax to a consumption tax produces a welfare gain for the United States of several trillion dollars.

Finally, a recent unpublished study by Dr. Allen Sinai of Primark Decision Economics shows that if the United States had switched in 1991 to a consumption tax system, in which all investment was expensed, all saving was deductible, and interest expense was not deductible, U.S. economic growth would have been significantly stronger over the past decade. Dr. Sinai’s results show that by 2004, real GDP would be 5 percent higher; business capital spending would be 35 percent higher; and saving, equities, and federal tax receipts would also be greater (see Tables 11 and 12).

Table 12

Federal Tax Receipt Impact of Switching to a Consumption Tax in 1991

|

(Billions of dollars)

|

Cumulative

1991–1995 |

Cumulative

1996–2000 |

Cumulative

2001–2004 |

| Total receipts | |||

| Base |

6,210.50

|

8,853.20

|

9,179.30

|

| Simulation of consumption tax |

5,745.50

|

8,821.00

|

9,607.70

|

| (Difference in level) |

-465

|

-32.2

|

428.5

|

| Personal | |||

| Base |

2,528.60

|

4,008.30

|

4,076.00

|

| Simulation of consumption tax |

2,600.20

|

4,372.50

|

4,657.70

|

| (Difference in level) |

71.5

|

364.2

|

581.7

|

| Personal-ordinary income | |||

| Base |

2,358.10

|

3,581.90

|

3,594.20

|

| Simulation of consumption tax |

2,424.60

|

3,939.10

|

4,166.90

|

| (Difference in level) |

66.6

|

357.3

|

572.7

|

| Personal-capital gains |

170.5

|

426.4

|

481.8

|

| Simulation of consumption tax |

175.5

|

433.3

|

490.8

|

| (Difference in level) |

5

|

6.9

|

9

|

| Corporate | |||

| Base |

911.1

|

1,286.20

|

1,503.90

|

| Simulation of consumption tax |

378.7

|

793.5

|

1,149.80

|

| (Difference in level) |

-532.4

|

-492.7

|

-354.1

|

| Corporate-ordinary | |||

| Base |

762.8

|

1,141.40

|

1,332.10

|

| Simulation of consumption tax |

209.4

|

612.3

|

956.3

|

| (Difference in level) |

-553.4

|

-529.1

|

-375.8

|

| Corporate-capital gains | |||

| Base |

148.2

|

144.8

|

171.8

|

| Simulation of consumption tax |

169.3

|

181.2

|

193.5

|

| (Difference in level) |

21.1

|

36.4

|

21.7

|

| Excise | |||

| Base |

433.3

|

492.7

|

445.5

|

| Simulation of consumption tax |

432.9

|

506.3

|

476.7

|

| (Difference in level) |

-0.3

|

13.6

|

31.2

|

| Social insurance | |||

| Base |

2,337.60

|

3,065.90

|

3,154.00

|

| Simulation of consumption tax |

2,333.70

|

3,148.70

|

3,323.50

|

| (Difference in level) |

-3.9

|

82.7

|

169.6

|

| Source: Allen Sinai, “Macroeconometric Model Simulation With the Sinai-Boston Model of the U.S. Economy,” unpublished study, 2001. | |||

Unfinished Business in Tax Policy Reform: Long-Run Goals

Fundamental reform of the U.S. federal tax code remains a key goal for many policymakers. Many prominent members of Congress, including House Majority Leader Richard Armey (R-TX); Senator Richard Shelby (R-AL); Senator Pete Domenici (R-NM); and Representative Billy Tauzin (R-LA), have all introduced legislation in recent years to replace the federal income tax with a broad-based consumption tax. House Minority Leader Richard Gephardt (D-MO) has proposed broadening the current income tax base while lowering rates (see Appendix A for comparison).

In addition to political factors such as voter discontent with the income tax, several factors contribute to the current interest in tax reform.

- The recognition that today’s balanced federal budget is likely to be a relatively short-lived phenomenon. A new study by the General Accounting Office (GAO) predicts that, absent improvement in GDP growth rates or policy changes such as reduced social security benefits, budget deficits will re-emerge by 2012 as baby boomers begin to retire. Tax reform, by encouraging more saving and investment, could be an important tool as we seek to ensure a strong economy in the twenty-first century.

- A growing awareness that the U.S. federal tax code is biased against the saving and investment that is crucial to improving U.S. economic growth. The new GAO study observes that even though federal budget deficits have declined recently, total national saving and investment remain significantly below the average of the 1960s and 1970s (see Table 1). In addition, as described above, the United States has one of the highest tax rates on new investment in the industrialized world.

- U.S. multinationals’ goal of competing in the global marketplace. Fundamental tax reform could enhance the ability of U.S. firms to compete in global markets by reducing the competitive disadvantage that they face.

- The conclusions of new economic studies by academic and public-sector tax policy experts. Essentially, fundamental tax reform could raise rates of saving, investment, and output, and boost our ability to maintain military preparedness. As discussed earlier in this statement, a number of new academic and government studies conclude that switching to a consumption-based tax system would increase national saving, reduce the cost of capital, and lead to higher levels of capital formation and GDP.

Conclusions

To meet the economic policy challenges we face within the next 15–20 years, plans for major tax reform should be at the forefront of policymakers’ agendas. A substantial body of research suggests that fundamental tax reform and more reliance on consumption taxes could have a profound, positive effect on long-term economic growth. Even small changes in economic growth rates can make a big difference in living standards. As the United States faces the economic challenges of the twenty-first century, including funding the retirement of the “baby boom” generation, fundamental tax reform that moves the U.S. tax system toward greater reliance on consumption taxes can be an important policy lever for achieving stronger economic growth, higher living standards, and military strength.

Endnotes

1. See “Fixing the Saving Problem: How the Tax System Depresses Saving and What to Do About It,” by Steve Entin, in the Institute for Policy Innovation’s The Road Map to Tax Reform series for more details on the importance of saving.

2. Kevin A. Hassett, Tax Policy and Investment (Washington, D.C.: American Enterprise Institute, 1999).

3. Enterprise Economics and Tax Reform (Washington, D.C.: Progressive Foundation, Progressive Policy Institute, October 1994).

4. Dale W. Jorgenson and Kun-Young Yun, Investment Volume 3: Lifting the Burden: Tax Reform, the Cost of Capital, and U.S. Economic Growth (Cambridge, Mass.: MIT Press, 2001).

5. James Poterba, “The Estate Tax and After-Tax Investment Returns,” NBER Working Paper No. 6337 (Cambridge, Mass.: National Bureau of Economic Research, December 1997).

6. Douglas Holtz-Eakin and Donald Marples, “Estate Taxes, Labor Supply, and Economic Efficiency” Special Report (Washington, D.C.: American Council for Capital Formation Center for Policy Research, January 2001).

7. Allen Sinai, “Macroeconomic and Revenue Impacts of Estate Tax Reform,” ; (Washington, D.C.: American Council for Capital Formation Center for Policy Research, March 2001).

8. For a full discussion of the marginal rate on personal and business income, see Entin, “Fixing the Saving Problem,” pp. 31–32. For the Arthur Andersen survey of 24 countries, see “Small Saver Incentives: An International Comparison of the Taxation of Interest, Dividends, and Capital Gains” Special Report (Washington, D.C.: American Council for Capital Formation Center for Policy Research, October 1998).

9. Alan J. Auerbach, David Altig, Laurence J. Kotlikoff, Kent A. Smetters, and Jan Walliser, “Simulating U.S. Tax Reform,” NBER Working Paper No. 6248 (Cambridge, Mass.: National Bureau of Economic Research, October 1997).

10. Joint Committee on Taxation, “Tax Modeling Project and 1997 Tax Symposium Paper,” November 20, 1997.

11. Congressional Budget Office, “The Economic Effects of Comprehensive Tax Reform,” July 1997.

12. Eric M. Engen and Jonathan Skinner, “Taxation and Economic Growth,” NBER Working Paper No. 5826 (Cambridge, Mass.: National Bureau of Economic Research, November 1996).

13. Hassett, Tax Policy and Investment (The AEI Press, 1999).

14. Jorgenson and Yun, Investment Volume 3: Lifting the Burden.

Appendix

Table A

Consumption Tax Proposals

|

Flat Tax

|

USA Tax

|

Retail Sales Tax

|

Gephardt

10 Percent Tax |

|

| Description | Rep. Richard Armey (R-TX) and Sen. Richard Shelby (R-AL) have introduced H.R. 1040/S. 1040, the Freedom and Fairness Restoration Act, in the 105th Congress. The bill replaces the current individual and corporate federal income taxes with a flat tax which approaches a pure consumption tax. | Sen. Pete Domenici (R-NM) introduced S. 722, the Unlimited Savings Account Tax (USA Tax), in the 104th Congress. The bill would replace the individual and corporate federal income taxes and provide a credit for Social Security and health insurance taxes paid. USA is a consumption tax for individuals and a subtraction-method value-added tax (VAT) for businesses. | Reps. Dan Schaefer (R-CO) and Billy Tauzin (R-LA) have introduced H.R. 2001, the National Sales Tax Act of 1997, in the 105th Congress. The bill replaces the current individual and corporate federal income tax with a national retail sales tax (NRST) on final consumers. It also repeals estate, gift, and most excise taxes. | Rep. Richard A. Gephardt (D-MO) has proposed broadening the income tax base by eliminating many of the current deductions and exclusions, and instituting a lower, progressive tax rate schedule and eliminating the “marriage penalty.” The proposal will be introduced as legislation by April 15, 1998. |

| Major Features of Individual Tax | ||||

| Tax Base Includes | Wages, salaries, personal service income, and pension distributions (except Social security benefits). | Wages, salaries, fringe benefits, interest and dividends received which are not reinvested, capital gains not reinvested, inheritances, rent, the includable portion of Social Security, profits from business activity, and reductions in net saving. | Individuals do not file a tax return unless they are engaged in retail business. All retail sales of goods and services, including home purchases, rent, financial services, and health care are subject to tax. | Wages, salaries, fringe benefits (except health insurance), employer-sponsored pension contributions, interest (both taxable and also interest exempt under current law), dividends, capital gains, business income, rents, royalties, unemployment compensation, and taxable portion of Social Security benefits (as under current law). |

| Tax Base Excludes | Interest and dividends received, rent, capital gains, inheritances, and foreign source income. However, interest and dividends are taxed at the business level. | Net increase in saving and repayment of debt. | No specific exclusions. | N.A. |

| Deductions/Adjustments | None. | Mortgage interest, charitable contributions, tax-exempt bonds, tuition (up to a limit), net new saving. | None. | Only the following are allowed: mortgage interest, ordinary business expenses, employer-provided health insurance, investment interest expenses, alimony paid, half of self-employment taxes. |

| Personal Exemptions, Family of Four | $33,800. Allowances are indexed for inflation. | $17,600 | Schaefer/Tauzin provides every wage earner with a refund equal to the sales tax times the poverty level of income. | $27,750 |

| Tax Rate | 20% (17% after third year). | Progressive rates of 8–40% phased in over 5 years. Effective rate would be lower than statutory rate for most taxpayers due to payroll tax credit. | 15%. | Progressive rates of 10–34%, however, proposal states that 10% rate would apply for family of 4 earning up to about $61,000 per year. |

| Payroll Tax | No change. | Refundable credit for employee portion of payroll taxes. | No change. | No change. |

| EITC | Repealed. | Credit would be revised to reflect shift from income to consumption tax base. It would retain current code’s progressivity. | Repealed. Schaefer/Tauzin provide a personal consumption refund for all wage earners. | No change. |

| Major Features of Business Tax | ||||

| Tax Base and Deductions/Adjustments | All businesses subject to the flat tax. Tax base is gross revenue less purchases of goods and services, capital equipment, structures, land, and wages and pension benefits paid to employees. Tax and interest expense, and fringe benefits such as health insurance, are not deductible. | All businesses are subject to the USA Tax. Tax base is gross revenue less purchases of goods and services, capital equipment, structures and land, and state and local government taxes. Wages and salaries, tax and interest expense, contributions to pension funds, and benefits such as health insurance are not deductible. | All businesses must collect the NRST on final sale to consumer. Sales from one business to another are exempt to prevent cascading. Tax base is gross revenue from each retail sale of goods and services. | No details provided. Gephardt proposes to raise taxes on large corporations by $50 billion through elimination of provisions in the current code. |

| Foreign-Source Income, Exports and Imports | All foreign income is exempt from tax. The tax is imposed on an “origin” basis (income from production of goods and services is taxed in country where produced); no deduction for exports nor any taxation on imports. | All foreign income is exempt from tax. The tax is imposed on a “territorial” basis (only consumption within the United States is taxed). Exports are exempt and imports are taxed. | All foreign source income is exempt from tax. The tax is imposed on a “territorial” basis (only consumption within the U.S. is taxed). Exports are exempt and imports are taxed. | No details provided. |

| Tax Rate | 20% (17% after third year). | 11%. Employer portion of the payroll tax can be credited against the business tax. | 15%. | No change. |

About the Author

Margo Thorning is Senior Vice President and Chief Economist of the American Council for Capital Formation, an influential advocate for American business. She also serves as Senior Vice President and Director of Research for the ACCF Center for Policy Research, the ACCF’s research and educational affiliate, which focuses on pro-capital formation tax and environmental policies.

Dr. Thorning is an internationally recognized expert on tax, environmental, and competitiveness issues. She writes and lectures on tax and economic policy, is frequently quoted in the national and local press (including the Wall Street Journal, Fortune, and the Washington Post ), and has appeared on national public affairs news programs. Dr. Thorning has testified as an expert witness on capital formation and environmental issues before various U.S. congressional committees including the Senate Energy and Natural Resources Committee, the Senate Governmental Affairs Committee, the House Ways and Means Committee, the House Commerce Committee, and the House Committee on Government Reform. She also has testified before the Senate of Canada on that country’s proposals for tax reform.

Dr. Thorning has made presentations abroad on the economic impact of climate change policy at forums sponsored by groups such as the Organization for Economic Co-operation and Development (OECD); the International Chamber of Commerce in Paris; the European Commission; the American Chamber of Commerce in Brussels; the International Federation of Industrial Energy Consumers; and the Centre for Global Energy Studies in London.

She is coeditor of numerous books on tax and environmental policy, including The Kyoto Commitments: Can Nations Meet Them With the Help of Technology?; Climate Change Policy: Practical Strategies to Promote Economic Growth and Environmental Quality; and The U.S. Savings Challenge: Policy Options for Productivity and Growth. Previously, Dr. Thorning served at the U.S. Department of Energy, the U.S. Department of Commerce, and the Federal Trade Commission.

Dr. Thorning received a B.A. from Texas Christian University, an M.A. in economics from the University of Texas, and a Ph.D. in economics from the University of Georgia.