Higher Immigration Will Reduce the Federal Deficit

CBO confirms a growing supply of labor, in part due to growth in immigration, will boost economic growth.

Tradeoffs

The Tax Relief for American Families and Workers Act of 2024 is a perfect example of the kinds of tradeoffs that must be made in order to move legislation. Should Republicans trade an expanded child tax credit for extended business tax cuts? And should the Democrats take the same deal? As Thomas Sowell says, “there are no solutions, there are only tradeoffs.”

Tabling TABOR

Colorado voters passed a TABOR Amendment in 1992 to ensure taxpayers benefited from state budget surpluses. That didn't stop the legislature from trying to undermine voters' intentions.

How Much Does $100 Billion in Federal Spending Cost You?

Americans would push back more on government spending if they knew how much each proposal would actually cost them.

Massachusetts Cuts--and Complicates--Taxes

You know progressives are concerned about tax flight when even Massachusetts decides to cut state tax rates.

Iowa Leads the Way on Tax Cuts

Iowa was once a leader in high individual and corporate income tax rates; now it's a leader in lowering those rates—and cutting spending.

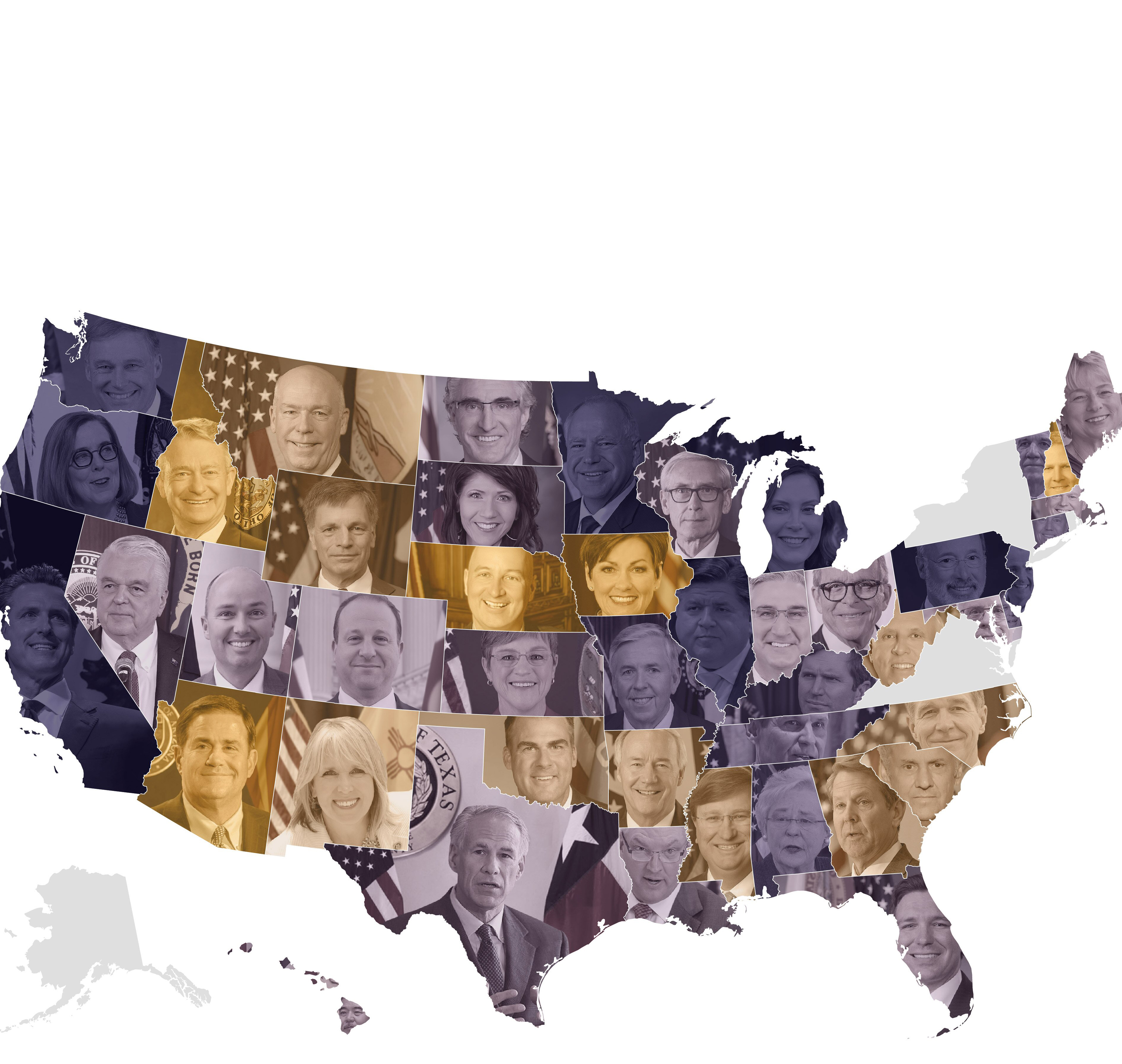

How to Judge Governors Running for President

Governors create a fiscal record that can help voters decide who might make the most fiscally responsible president.

Reducing 'Tax Expenditures' Can Hurt Economic Growth

Rethinking and bad thinking about the notion of "tax expenditures."

The Bizarre Economics of 'Tax Expenditures'

The term "tax expenditure" may not mean what you think it means.

Don't Trade SALT for Broccoli

Physicians may think too much salt is bad for your health, but many economists believe some SALT is good for the economy.