The GAO and New Tax Math: Computation By Deception

We need tax reform, and we need fact-finding government agencies to bring forward the facts instead of biased or misleading analysis.

Why Not Personal Accounts?

Personal Retirement Accounts (PRAs) should be the core of any conservative proposal for entitlement reform.

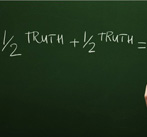

Reporting on Corporate Taxes: Two Half Truths Equal a Misrepresentation

Corporations pay a range of local, state and international taxes regardless of their federal tax liability which is not found in corporate reports. So, what is with these headlines about companies not paying much tax? Only half-truths.

Laffer's Curve-ball

Passing a law that radically expands the scope of government and then hoping, assuming, that all states will do the right thing is a set up to be thrown a real economic curve ball.

Carbon Taxes: Wrong Solution to the Wrong Problem

For the United States to place a punitive tax on carbon would be like Brazil putting a punitive tax on beaches.

Make It Permanent

Congress can make permanent the ban on Internet access and multiple or discriminatory taxes online, or allow the pro-tax thugs the chance to loot our digital future.

Why Are Companies Hoarding Cash?

There’s an enormous supply of cash that could be put to work in the economy. It dwarfs the size of any stimulus plan fantasized about by the wildest of Keynesian cheerleaders. But this administration just doesn’t get it.

Sixteen

Citizens are irritated by the current tax system. Can it be a surprise then that some people are ready to uproot the source of the problems and start over?

Let's Play: Who's the Constitutionalist?

Of all constituencies, the Tea Party should instinctively understand what’s wrong with the Marketplace Fairness Act

Success-ter

The dreaded and feared sequester has been a success. Policymakers should add blunt tools like the sequester as a backstop into every future fiscal agreement.